Boom Lift Financing

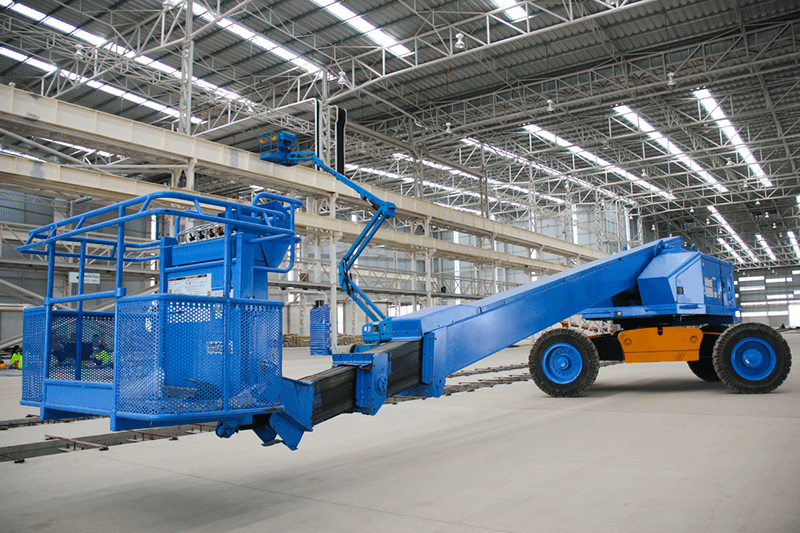

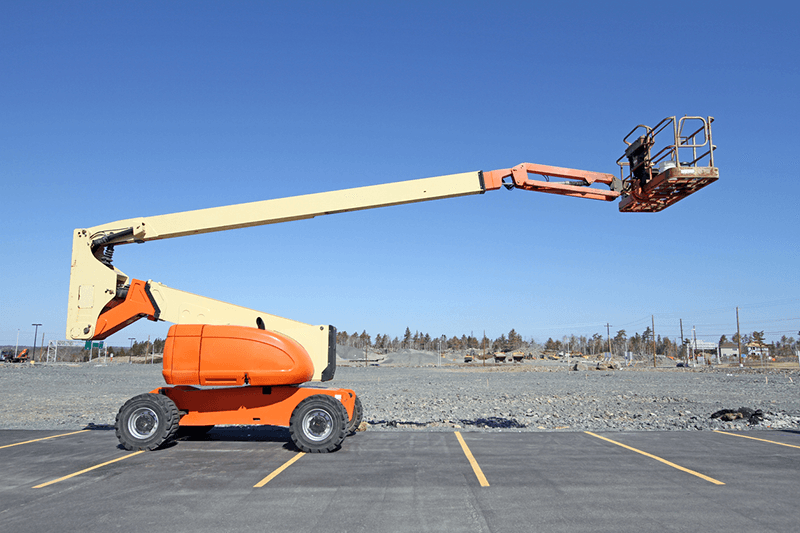

At Heavy Iron Capital, we offer fast, flexible boom lift financing—whether you’re purchasing an articulating lift, telescopic boom, or aerial work platform. With quick approvals, no hard credit checks, and competitive terms, we make it easy to get the lift equipment you need. We also finance related gear like telehandlers and scissor lifts, helping you expand your fleet and stay ready for any elevated job.

Finance Your Boom Lift with Confidence

Boom Lift Financing Built for Contractors Who Work at Height

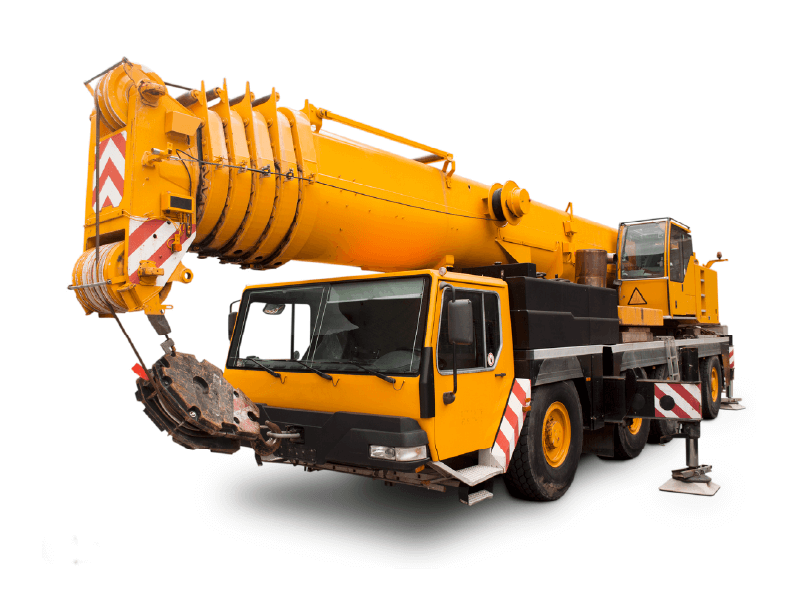

Heavy Iron Capital offers hassle-free boom lift financing tailored to your business. Whether you’re investing in an articulating boom lift, straight boom, or aerial platform, we provide fast approvals and flexible options to help you secure the equipment you need. We also finance related aerial and lift equipment—including telehandlers and even tower cranes—so you can scale your capabilities and meet the demands of any elevated jobsite.

Our financing programs are built for contractors, builders, and industrial maintenance teams who rely on safe and reliable lift equipment. From long-term rentals to full ownership, our equipment financing options come with no hard credit checks and terms that work with your cash flow.

Let Heavy Iron Capital help you take your next project to new heights—with a financing process that works as hard as you do.

Once you’re pre-approved by Heavy Iron Capital, your approval is valid for 90 days—with no additional credit checks required.

Get pre-approved in minutes with no hard credit inquiries and zero impact on your personal or business credit.

Construction equipment financing made easy. We’ve built a fast, hassle-free approval process with quick funding.

We finance any make and model of construction equipment—new or used, from any dealer or private seller.

We work with new businesses to help you secure the construction equipment you need to get started and grow.

Get pre-approved in minutes with no hard credit inquiries and zero impact on your personal or business credit.

Real Reviews By Equipment Owners Like You

Don’t just take our word for it—see what real customers have to say. From first-time buyers to seasoned operators, contractors across the country trust Heavy Iron Capital for fast, reliable financing and unmatched service. Here’s what they’re saying:

Equipment Finance Agreement (EFA)

Secure Your Boom Lift with Fixed Payments and Full Control

A Boom Lift Equipment Finance Agreement (EFA) offers a simple, effective way to finance a lift — giving you ownership without lease restrictions or balloon payments.

-

Use your boom lift as collateral

-

Fixed monthly payments with no surprises

-

Works well for used or specialty lifts

-

Easier to qualify for than a traditional loan

EFAs are a great option for contractors who want the benefits of ownership without the red tape of a lease.

⚡ Fast funding available with minimal paperwork.

Boom Lift Lease

Lower Payments, Greater Flexibility

Leasing a boom lift is ideal for contractors who want to reduce upfront costs and keep monthly payments low. You’ll get access to newer equipment without tying up your working capital.

-

Lease terms from 12 to 60 months

-

Lower monthly payments vs. loans

-

End-of-term options: purchase, renew, or return

-

Available for most lift brands and models

From short-term projects to long-term fleet planning, leasing gives you the control and flexibility to match your cash flow and equipment needs.

🔧 Ask about $0 down and Section 179 advantages.

Boom Lift Loans

Own Your Boom Lift With a Straightforward Loan

If you’re looking to purchase and fully own your boom lift, a traditional loan is a great fit. Our lift loans work for new or used equipment and are structured to help you build equity from day one.

-

Finance your boom lift

-

Terms from 24 to 60 months

-

Competitive fixed rates

-

Private party or dealer purchases accepted

Whether you’re expanding your fleet or replacing aging equipment, we’ll help you secure the financing that fits your budget and timeline.

👉 Apply in minutes — No hard inquiry required.

Frequently Asked Questions

What are typical terms for equipment financing?

Typical equipment financing terms range from 24 to 72 months, depending on the type of equipment, its age, and the borrower’s credit profile. At Heavy Iron Capital, we offer flexible term lengths to match your budget and cash flow needs. Down payments can vary—usually between 0% up to 40%—and interest rates depend on factors like credit strength, time in business, and the equipment being financed. We work with both established businesses and startups to find terms that make sense for your operation.

What are the requirements for equipment financing?

How hard is it to get equipment financing?

What credit score do you need for equipment financing?

How long can you finance construction equipment?

Heavy Equipment Financing

Flexible Financing for Excavators, Loaders, Cranes, Dump Trucks, and More

Looking to grow your construction business with reliable construction equipment financing? At Heavy Iron Capital, we make it easy to secure funding for the heavy machinery you need to get the job done. Whether you’re financing a new excavator, backhoe, dump truck, bulldozer, or loader, our flexible programs are built to support contractors, owner-operators, and growing fleets. We finance all major types of yellow iron with fast approvals, no hard credit pull, and dedicated support from start to finish.

Earthmoving Equipment

Construction Trucks

Cranes & Lifts

Construction News

Your Source for the Latest Construction Industry News

Our construction blog covers everything you need to know about construction equipment, financing strategies, industry news, and business tips for contractors. Whether you’re running a small grading crew or managing a growing construction company, we’ve got the insights to help you make smarter equipment decisions and grow your business.

Top 10 Best Excavator Brands in the USA

Excavators: Your Complete Guide for Excavators