Service Truck Financing

At Heavy Iron Capital, we specialize in flexible service truck financing—whether you’re investing in a mechanic truck, utility truck, or field service vehicle. Our fast approvals, competitive terms, and no hard credit checks make it easy to get the equipment you need to keep your operation running. We also finance related equipment like water trucks and dump trucks, giving you convenient options to grow your fleet and stay job-ready.

Finance Your Next Service Truck with Confidence

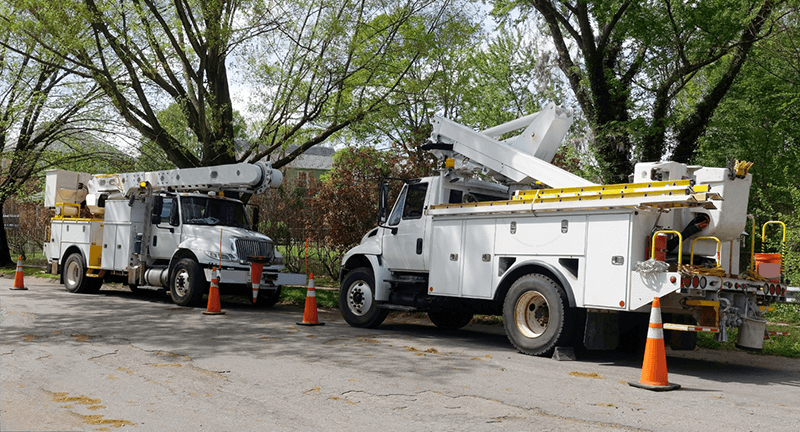

Service Truck Financing That Keeps Your Team Moving

At Heavy Iron Capital, we provide flexible, fast service truck financing—whether you need a mechanic truck, utility service truck, or field repair vehicle. Our financing solutions are built for contractors, equipment operators, and field service teams that rely on mobile repair and maintenance trucks to stay productive. In addition to service trucks, we also finance related equipment like water trucks and dump trucks, giving you a convenient way to grow your fleet and keep your projects moving forward with a variety of financing options.

With quick approvals, competitive terms, leasing options, and no hard credit checks, Heavy Iron Capital makes getting the right service truck simple and efficient.

Once you’re pre-approved by Heavy Iron Capital, your approval is valid for 90 days—with no additional credit checks required.

Get pre-approved in minutes with no hard credit inquiries and zero impact on your personal or business credit.

Construction equipment financing made easy. We’ve built a fast, hassle-free approval process with quick funding.

We finance any make and model of construction equipment—new or used, from any dealer or private seller.

We work with new businesses to help you secure the construction equipment you need to get started and grow.

Get pre-approved in minutes with no hard credit inquiries and zero impact on your personal or business credit.

Real Reviews By Equipment Owners Like You

Don’t just take our word for it—see what real customers have to say. From first-time buyers to seasoned operators, contractors across the country trust Heavy Iron Capital for fast, reliable financing and unmatched service. Here’s what they’re saying:

Equipment Finance Agreement (EFA)

Secure Your Service Truck with Fixed Payments and Full Control

A Service Truck Equipment Finance Agreement (EFA) offers a simple, effective way to finance a service truck — giving you ownership without lease restrictions or balloon payments.

-

Use your service truck as collateral

-

Fixed monthly payments with no surprises

-

Works well for used or specialty service trucks

-

Easier to qualify for than a traditional loan

EFAs are a great option for contractors who want the benefits of ownership without the red tape of a lease.

⚡ Fast funding available with minimal paperwork.

Service Truck Lease

Lower Payments, Greater Flexibility

Leasing a service truck—whether it’s a mechanic truck, utility truck, or field repair truck—is a smart option for contractors looking to reduce upfront costs and keep monthly payments low. It gives you access to newer equipment without tying up your working capital.

-

Lease terms from 12 to 60 months

-

Lower monthly payments vs. loans

-

End-of-term options: purchase, renew, or return

-

Available for most service truck brands and models

From short-term hauling projects to long-term fleet planning, leasing gives you the control and flexibility to match your cash flow and equipment needs.

🔧 Ask about $0 down and Section 179 advantages.

Service Truck Loans

Own Your Service Truck With a Straightforward Loan

If you’re looking to purchase and fully own your service truck, a traditional loan is a great fit. Our service truck loans work for new or used equipment and are structured to help you build equity from day one.

-

Finance your 2 or 3-axle service truck

-

Terms from 24 to 60 months

-

Competitive fixed rates

-

Private party or dealer purchases accepted

Whether you’re expanding your fleet or replacing aging equipment, we’ll help you secure the financing that fits your budget and timeline.

👉 Apply in minutes — No hard inquiry required.

Frequently Asked Questions

What are typical terms for equipment financing?

Typical equipment financing terms range from 24 to 72 months, depending on the type of equipment, its age, and the borrower’s credit profile. At Heavy Iron Capital, we offer flexible term lengths to match your budget and cash flow needs. Down payments can vary—usually between 0% up to 40%—and interest rates depend on factors like credit strength, time in business, and the equipment being financed. We work with both established businesses and startups to find terms that make sense for your operation.

What are the requirements for equipment financing?

How hard is it to get equipment financing?

What credit score do you need for equipment financing?

How long can you finance construction equipment?

Heavy Equipment Financing

Flexible Financing for Excavators, Loaders, Cranes, Dump Trucks, and More

Looking to grow your construction business with reliable construction equipment financing? At Heavy Iron Capital, we make it easy to secure funding for the heavy machinery you need to get the job done. Whether you’re financing a new excavator, backhoe, dump truck, bulldozer, or loader, our flexible programs are built to support contractors, owner-operators, and growing fleets. We finance all major types of yellow iron with fast approvals, no hard credit pull, and dedicated support from start to finish.

Earthmoving Equipment

Construction Trucks

Cranes & Lifts

Construction News

Your Source for the Latest Construction Industry News

Our construction blog covers everything you need to know about construction equipment, financing strategies, industry news, and business tips for contractors. Whether you’re running a small grading crew or managing a growing construction company, we’ve got the insights to help you make smarter equipment decisions and grow your business.

Top 22 Construction Equipment Types for Contractors

Compact Track Loaders vs Skid Steers for Contractors